For instance, the income threshold for the top tax rate, 37%, increased by $16,300 for individual filers in 2022 from 2021. The thresholds for each of the seven tax brackets increased. Tax season 2023: What exactly is the mileage rate? There's more than one. What is a 1098-E form? What you need to know about the student loan interest statement

#TAX BRACKETS 2022 MARRIED PLUS#

22% on the portion of income above $55,900 (but not over $89,050) plus an additional $6,415.

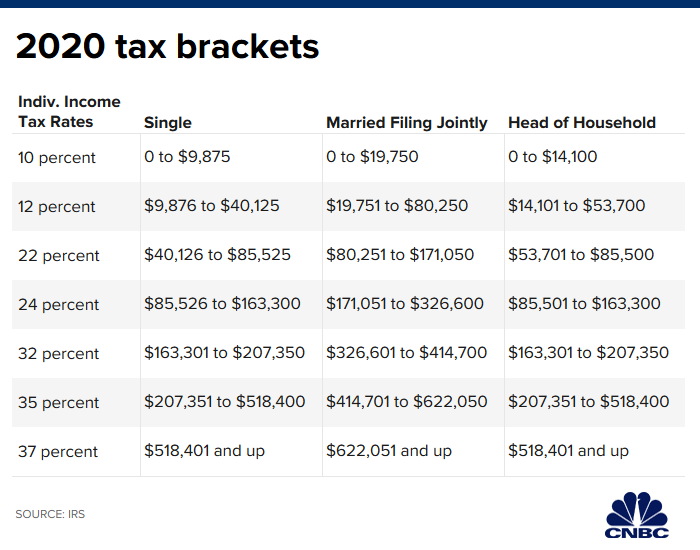

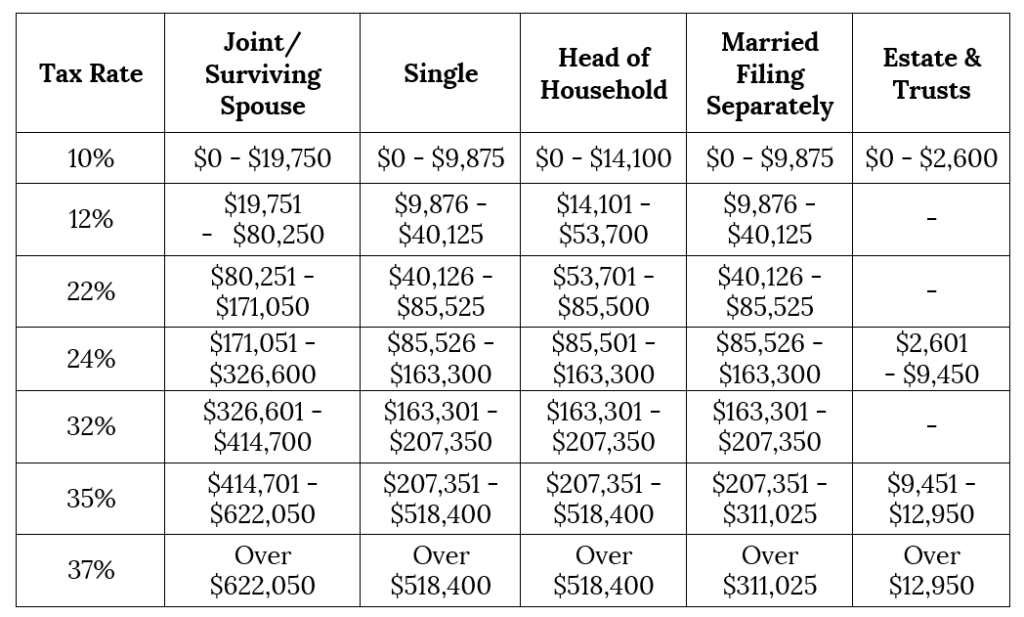

The heads of household tax brackets for this tax year are: Heads of households have higher income thresholds for each tax tax bracket than individual filersto account for the additional costs they cover. What is income tax? What to know about how it works, different types and more Tax brackets married filing jointly The tax brackets for married couples filing joint returns are:įor tax purposes, the IRS generally defines a head of a household as the parent who pays for more than half of their household's expenses. Tax season 2023 officially started: Here are key deadlines to keep in mind The 2022 tax brackets for people filing individual returns are: The highest individual tax bracket is 37% for people who earned more than 539,000 in 2022. "You're actually worse off even though your taxes may be lower," McClelland said. The inflation-adjusted brackets "aren't addressing the fact that your real income fell," meaning your income could cover fewer goods and services due to inflation throughout the year. It's not much of a savings though, McClelland said. But if your wages didn't keep up with inflation, which was the case for the average American worker in 2022, you could end up in a lower tax bracket compared to 2021. If your salary rose by more than the rate of inflation you may fall under a higher tax bracket. That means that if you got a raise to keep up with inflation you'll likely face the same tax rate as the prior year, all else equal. However, it does not account for increased wages. The procedure the IRS follows does "a pretty good job" of accounting for increased prices, said Robert McClelland, a senior fellow at the Urban-Brookings Tax Policy Center. The chained index tends to rise more slowly than CPI because it takes into account the substitutions consumers make in response to higher prices. The IRS uses the average year-over-year chained consumer price index readings for 12 months beginning in August of the prior year through September to make inflation adjustments for the upcoming tax year. States' 'flat tax' mania: Better for taxpayers or another gift to billionaires? Federal income tax bracket 2022 Tax guide for newlyweds: Should we file taxes jointly or separately? 23 is the earliest you can file your taxesġ099, W-4, W-2, W-9, 1040: What are these forms used for when filing your taxes? Tax bracket definitionĪ tax bracket is the range of incomes subject to a particular income tax rate. This is known as "bracket creep" since the raise likely doesn't leave you feeling richer because the cost of living rose, yet you'd find yourself paying more taxes.Įven though tax brackets change each year, higher-income people always will fall under higher tax brackets than lower-income people. If the IRS didn't adjust the federal income tax brackets for inflation you'd likely end up in a higher tax bracket since salaries are often adjusted for inflation. This is done to account for inflation which varies from year to year.

Every year, the Internal Revenue Service announces new tax brackets among other crucial credits and deductions that determine your tax rate for the upcoming year.

0 kommentar(er)

0 kommentar(er)